Blog Categories

- Appliances Ten

- Athletic Seating

- Auto Helpers

- Automated Stock Rooms

- Chocolate Ten

- Chris Lema Blog

- CuraFlo

- Damaged Goods Dating

- Flood Insurance Ten

- Game Addict

- Hi Tech Pest Control

- HVAC Ten

- Medical Labels Ten

- Mental Health Ten

- National CWS

- Promotional Ideas

- Seguros Lara Insurance

- Stem Cell Worx

- The Hidden Truth

- ThemeIsle Blog

- Torque

- Video Editing Ten

- Web Design Dev

- Website Development Ten

Ten osCommerce Master Blogs

The Most Trusted Source for general blog Information

We will provide informative articles on all sorts of topics.

Posted On: August 29, 2020

If you live in an area with any level of flood risk, you will want flood insurance. And if that risk is high, then you are required to purchase flood insurance before your mortgage company gives you a loan. And if you're a tenant, you may also want to buy flood insurance to protect your belongings in case of a flood.You may ask, I'm not near any water. My risk is low for flooding, so why should I purchase flood insurance? The answer is, flooding can happen anywhere to anyone. Without flood insurance, you could be spending thousands of dollars o . . . [More]

Posted On: August 29, 2020

If you live in an area with any level of flood risk, you will want flood insurance. And if that risk is high, then you are required to purchase flood insurance before your mortgage company gives you a loan. And if you're a tenant, you may also want to buy flood insurance to protect your belongings in case of a flood.You may ask, I'm not near any water. My risk is low for flooding, so why should I purchase flood insurance? The answer is, flooding can happen anywhere to anyone. Without flood insurance, you could be spending thousands of dollars o . . . [More]

Posted On: August 29, 2020

Owning a property comes with specific flood insurance requirements. For example, if you are looking at property in a high-risk flood area, your mortgage company will not give you a loan until you purchase flood insurance. High-risk areas are marked A and V on the FEMA flood risk map. Those living in a low to moderate risk may be wondering are they required to purchase flood insurance before taking out a loan? The answer is no, but at Holt Flood Insurance, we recommend that everyone buy flood insurance, regardless of the risk level. Homeowner's . . . [More]

Posted On: August 29, 2020

Owning a property comes with specific flood insurance requirements. For example, if you are looking at property in a high-risk flood area, your mortgage company will not give you a loan until you purchase flood insurance. High-risk areas are marked A and V on the FEMA flood risk map. Those living in a low to moderate risk may be wondering are they required to purchase flood insurance before taking out a loan? The answer is no, but at Holt Flood Insurance, we recommend that everyone buy flood insurance, regardless of the risk level. Homeowner's . . . [More]

flood insurance specifications

Posted On: August 28, 2020

Flood insurance specifications typically detail the coverage limits, eligibility, and exclusions for protecting property against flood-related damage. Here’s an overview of common elements you’ll find in flood insurance policies:1. Coverage TypesBuilding Property Coverage: Covers the structure of your home, including the foundation, electrical and plumbing systems, HVAC equipment, and built-in appliances.Personal Property Coverage: Covers personal belongings such as furniture, electronics, and clothing. This coverage may vary and often has . . . [More]

flood insurance specifications

Posted On: August 28, 2020

Flood insurance specifications typically detail the coverage limits, eligibility, and exclusions for protecting property against flood-related damage. Here’s an overview of common elements you’ll find in flood insurance policies:1. Coverage TypesBuilding Property Coverage: Covers the structure of your home, including the foundation, electrical and plumbing systems, HVAC equipment, and built-in appliances.Personal Property Coverage: Covers personal belongings such as furniture, electronics, and clothing. This coverage may vary and often has . . . [More]

Posted On: August 28, 2020

There are two types of flood policy coverage: building and contents. These factors determine how much you will pay for flood insurance. Home and business owners will purchase both together, while renters only need to pay for content insurance. Just like regular insurance, flood insurance has its limits when it comes to coverage. And policies may vary between flood insurance companies.When it comes to flood insurance, the following items may not be covered, temporary housing, landscaping, decks, pools and anything else outside of the insured pro . . . [More]

Posted On: August 28, 2020

There are two types of flood policy coverage: building and contents. These factors determine how much you will pay for flood insurance. Home and business owners will purchase both together, while renters only need to pay for content insurance. Just like regular insurance, flood insurance has its limits when it comes to coverage. And policies may vary between flood insurance companies.When it comes to flood insurance, the following items may not be covered, temporary housing, landscaping, decks, pools and anything else outside of the insured pro . . . [More]

private flood insurance companies list

Posted On: August 28, 2020

If you are going through a private flood insurance companies list and don't know which one to choose from, Holt Flood Insurance is here to help. With over 30 years of flood insurance experience, we can help you decide which company offers the best rates and coverage for you and your property.If you are wondering why flood insurance is needed, consider this. If your home is near a body of water, the chances for flooding increase significantly. Especially during a rainstorm or heavy snowfall. And if flooding should happen and you are without floo . . . [More]

private flood insurance companies list

Posted On: August 28, 2020

If you are going through a private flood insurance companies list and don't know which one to choose from, Holt Flood Insurance is here to help. With over 30 years of flood insurance experience, we can help you decide which company offers the best rates and coverage for you and your property.If you are wondering why flood insurance is needed, consider this. If your home is near a body of water, the chances for flooding increase significantly. Especially during a rainstorm or heavy snowfall. And if flooding should happen and you are without floo . . . [More]

Does My Homeowners Insurance Cover Flooding?

Posted On: August 28, 2020

One of the first things homeowners will purchase after buying a home is home insurance. Homeowner's insurance is needed to protect your home and valuables in the case of an emergency. Without it, you can be spending thousands of dollars on repairing your home and replacing lost valuables. But will your homeowner's insurance cover flood damage? Yes and no. If an accident such as your water heater explodes or a burst pipe, your homeowner's insurance will cover the damages.However, in the case of a flooding incident caused by rising waters, you wi . . . [More]

Does My Homeowners Insurance Cover Flooding?

Posted On: August 28, 2020

One of the first things homeowners will purchase after buying a home is home insurance. Homeowner's insurance is needed to protect your home and valuables in the case of an emergency. Without it, you can be spending thousands of dollars on repairing your home and replacing lost valuables. But will your homeowner's insurance cover flood damage? Yes and no. If an accident such as your water heater explodes or a burst pipe, your homeowner's insurance will cover the damages.However, in the case of a flooding incident caused by rising waters, you wi . . . [More]

Posted On: August 28, 2020

Cryo or cryogenic labels are designed to tolerate extended storage in liquid or vapor phase liquid nitrogen and ultra-low temperature freezers. The face material and adhesive of cryogenic labels are created to remain intact when stored under extremely cold temperatures, and usually for an extended period of time. If labels not engineered for this purpose are used in these conditions, you risk labels falling off the container and ultimately leading to a loss of sample integrity.How are Cryo Labels Used?Cryo labels are most commonly used for medi . . . [More]

Posted On: August 28, 2020

Cryo or cryogenic labels are designed to tolerate extended storage in liquid or vapor phase liquid nitrogen and ultra-low temperature freezers. The face material and adhesive of cryogenic labels are created to remain intact when stored under extremely cold temperatures, and usually for an extended period of time. If labels not engineered for this purpose are used in these conditions, you risk labels falling off the container and ultimately leading to a loss of sample integrity.How are Cryo Labels Used?Cryo labels are most commonly used for medi . . . [More]

Pandemic upends nonprofit therapy treatment model

Posted On: August 28, 2020

Pictured: CHR therapist Nicolle Wargo working with a child via telehealth. Wargo works in CHR’s Child Outpatient Clinic in Bloomfield.

By Liese Klein

Jane Garcia has gone on scavenger hunts with her young clients, played board games and even traveled around the world via Google Earth.

A licensed professional counselor and art therapist at Community Health Resources in Manchester, Garcia has been doing all of her work with young people in recent months via videoconferencing or “telehealth,” a mode of treatment that she said had been both . . . [More]

Pandemic upends nonprofit therapy treatment model

Posted On: August 28, 2020

Pictured: CHR therapist Nicolle Wargo working with a child via telehealth. Wargo works in CHR’s Child Outpatient Clinic in Bloomfield.

By Liese Klein

Jane Garcia has gone on scavenger hunts with her young clients, played board games and even traveled around the world via Google Earth.

A licensed professional counselor and art therapist at Community Health Resources in Manchester, Garcia has been doing all of her work with young people in recent months via videoconferencing or “telehealth,” a mode of treatment that she said had been both . . . [More]

Protect Your Home with Flood Insurance

Posted On: August 27, 2020

Flood risk is a serious concern for homeowners, regardless of their location. Understanding your flood risk can help you make informed decisions about flood insurance and ensure that your property is adequately protected. Here’s what you need to know about flood risk and how it impacts your insurance needs.1. What is Flood Risk?Flood risk refers to the likelihood of your property experiencing flooding. This risk is determined by factors such as your location, the type of flooding (river, coastal, or flash floods), and the elevation of your ho . . . [More]

Protect Your Home with Flood Insurance

Posted On: August 27, 2020

Flood risk is a serious concern for homeowners, regardless of their location. Understanding your flood risk can help you make informed decisions about flood insurance and ensure that your property is adequately protected. Here’s what you need to know about flood risk and how it impacts your insurance needs.1. What is Flood Risk?Flood risk refers to the likelihood of your property experiencing flooding. This risk is determined by factors such as your location, the type of flooding (river, coastal, or flash floods), and the elevation of your ho . . . [More]

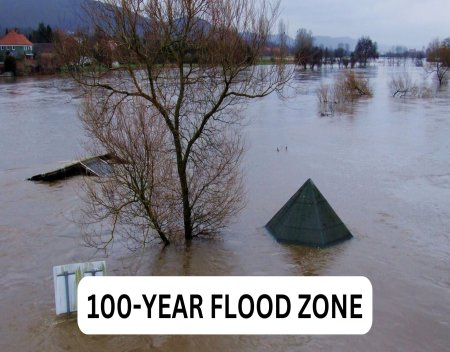

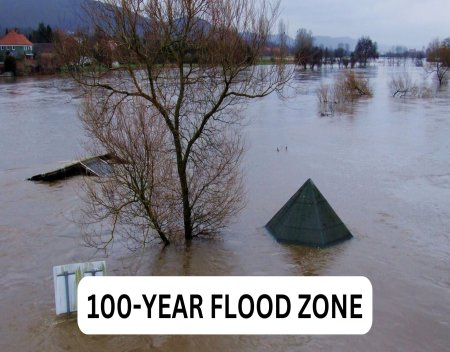

Posted On: August 27, 2020

What is a 100-year flood zone? This term can often be confusing to people. They may think that the possibility of high flood levels can only happen once every 100 years. The term 100-year flood means that there is a one percent chance that extreme flooding can occur during any year.Even a tiny amount of water can cause significant damage. That is why flood insurance is essential regardless of flood risk. While you have flood coverage with your home insurance, it only applies to accidental flooding, not weather related. You can purchase flood in . . . [More]

Posted On: August 27, 2020

What is a 100-year flood zone? This term can often be confusing to people. They may think that the possibility of high flood levels can only happen once every 100 years. The term 100-year flood means that there is a one percent chance that extreme flooding can occur during any year.Even a tiny amount of water can cause significant damage. That is why flood insurance is essential regardless of flood risk. While you have flood coverage with your home insurance, it only applies to accidental flooding, not weather related. You can purchase flood in . . . [More]